Hey there! This post contains affiliate links. Using my links means I earn a commission, which helps me create more rad content. More on affiliates here.

In 2019, I began my personal finance education in earnest. Sure, I took a class on financial literacy in high school – but I remembered, errr, nothing from it.

How I Paid Off My Wells Fargo Credit Card

I started learning about building my credit and setting up an investing plan, and I had to face the music on my consumer credit card from Wells Fargo. If I could go back, I would choose a different bank to use at 18, as I don’t agree with many (most) of the decisions of this bank.

Live and learn.

My Wells Fargo College Credit Card

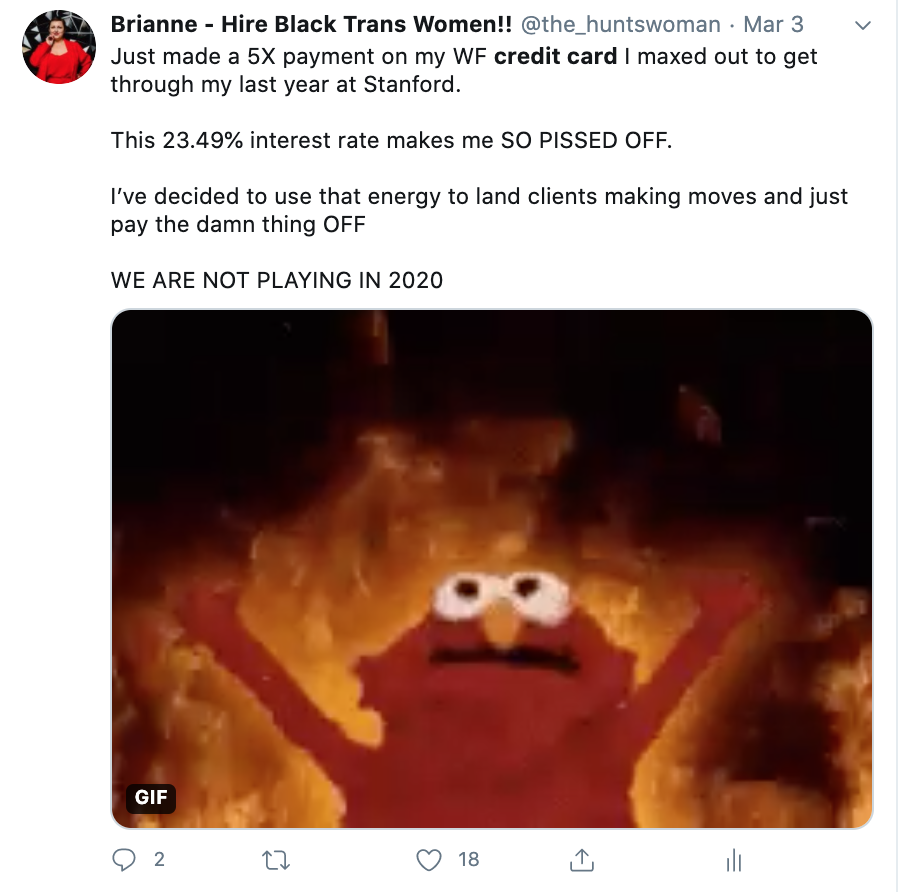

I maxed out this card during college, finishing up my last year of school. I hadn’t charged anything to it for years, and I had been chipping away at it.

It was time to dive in!

Reading My Statement For The First Time

In the midst of doing my financial education, I made a not-so-fun discovery. I was going through my Wells Fargo credit card statement. As I was reading through my statement (for the first time, ever) I was surprised at how much of my monthly payments were going to interest.

I was paying out about $80 a month on interest alone, which seemed really high for a card with around $4,000 on it at 10% APR?

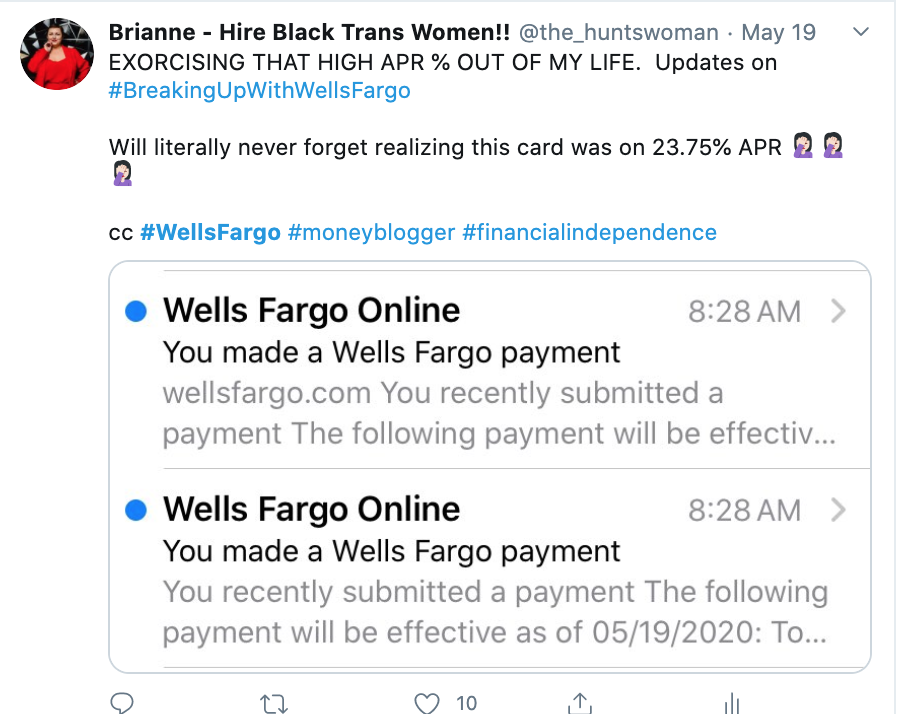

Wait, This Wells Fargo Credit Card is at 23.75% APR?!

Remember how I maxed out that card during college? I didn’t make purchases directly on that card. I transferred the money from my credit card account directly to my debit card.

AND, turns out, there’s a little loophole on the Wells Fargo College Credit Card. That APR jumps up to 23.75% if you make cash transfers between accounts.

Super.

Time to Break Up with Wells Fargo

Well, as you can imagine, this realization ticked me RIGHT OFF. This is predatory, in my opinion. College kids aren’t going to see the fine print on this contract, and they’re going to more than double their APR on their credit card???? WTF?!

Let’s Pay This Off ASAP!

So, I started scheming on how to pay off this card. Here are the tactics I used:

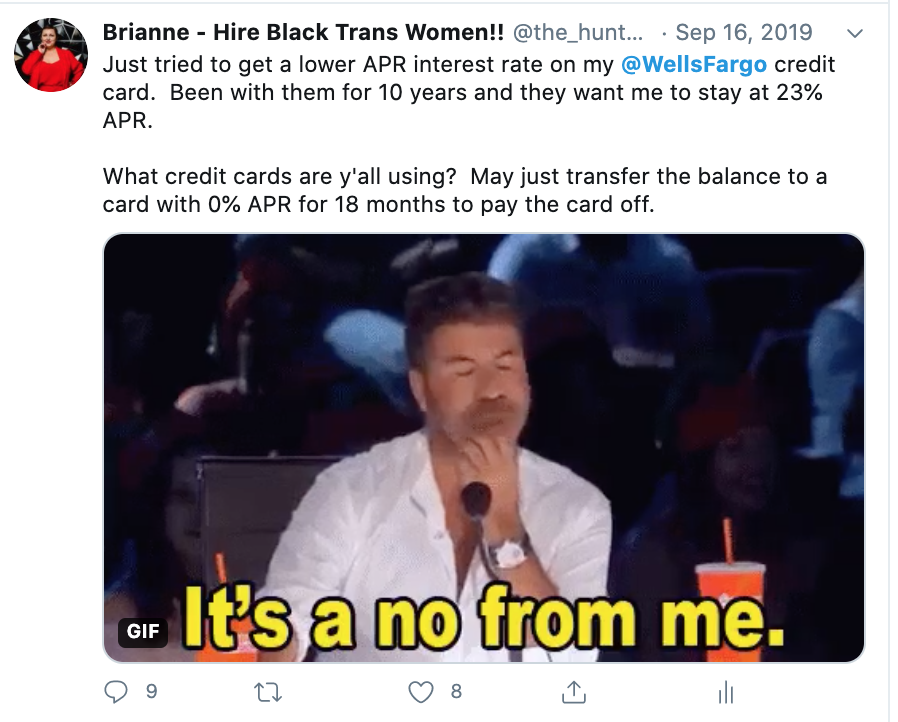

Tactic #1: Call Wells Fargo to Get a Lower Interest Rate

In the book, “I Will Teach You to Be Rich,” the author shares a script for you to use with your credit card company. I had been banking with Wells Fargo for over ten years, so surely I could bank on that?

Nope! The friendly representative on the phone wouldn’t budget.

Tactic #2: Refinance My Wells Fargo Credit Card

I tried to refinance the card and move the balance to a 0% APR card. No go! My credit score was just over 600, and I didn’t qualify for the 2 cards I applied for.

Tactic #3: Adjust Bill Payments On Other Accounts

In the same book that I mentioned before, “I Will Teach You to Be Rich,” the author advises that you prioritize paying off debt by whatever has the highest APR %.

This card definitely had the highest APR or interest rate for me, so I started throwing more of my discretionary funds at it. Seeing that such a huge chunk of my payment was going towards interest ticked me right off.

Tactic #4: Allocate Revenue Streams to The Credit Card

This isn’t applicable to everyone, but as a self-employed person I have different streams of income. I dedicated the net earnings from different service types (one-off consults and cover letters) to this card. As other random gigs popped up, I also threw that money at the card.

Tactic #5: Using My Vision Board and Visualization

I meditate daily, visualizing things in my life that I want to bring about. As part of that daily practice, I envisioned myself going to the card (and my WF Student Loan) and paying it off in full.

This helped me keep my eye on the prize, and it also added extra fire in my daily life to earn more money to pay it off.

Curve Ball – Wells Fargo Sent Me A Replacement Credit Card (without My Asking!)

So, get this. I haven’t made a purchase on this card for about 3 years at this point. After I had paid off a couple grand, Wells Fargo sent me a replacement card in the mail.

You know, just in case I needed to use it to buy something.

I shredded it immediately on opening the envelope.

I Hesitated To Pay off The Last $800 ish

Something that I DIDN’T expect was to feel anxious and freaked out about paying off my Wells Fargo credit card. I picked up a host of excuses, thinking to myself, “Well, it’s gonna suck when life makes me max it out again!” and “What if I have to use a lot of this card again? How embarrassing will that be?”

Change can be scary, and we’re programmed to stick with our “money programming” we’ve had in the past. This is why people make poor decisions with money – because money is emotional.

I sat with those feelings and then paid the dang card off!

(If you’re looking to get past the money feels you grew up with and still battle against, I highly recommend reading, “You Are a Bad@SS at Making Money” by Jen Sincero.)

My Credit Plan Moving Forward

I shared more about how I’m building my credit score here, and once I hit 700 I’ll likely be getting the Chase Sapphire Card or the CostCo credit card. I don’t know if I’ll turn into a “credit card hacker” with 5+ cards to max out perks, but I am definitely moving forward with different practices around credit.

What to Read Next —>

- LGBT Folks & Personal Finance

- 7 Personal Finance Books I Recommend

- How to Make More Money

- Checklist for a Job Interview

- Streaks App Review – Worth the Money?

Love Money & Fashion?

More of an email kind of person? Join my email list here, and my fashion email list here!

Prefer to connect on social media? If you want to stay up-to-date on my reviews, I recommend joining me on your favorite social media platform (Instagram, TikTok or Twitter).