Hey there! This post contains affiliate links. Using my links means I earn a commission, which helps me create more rad content. More on affiliates here.

If you’ve been following me on my Instagram Story or Twitter, you know that I’ve been leveling up in my financial journey.

From hiring a year-round accounting firm for my taxes (woo self-employment), to listening to podcasts to figure what the heck a “Roth IRA” is to tackling my daily finances.

Whew. Adulting can be tough.

[Heads up! This post uses affiliate links, and you help me earn $$ when you use my links. More on affiliate links here!]

Why I’m Talking about Money

I know I’m not alone in my experience here. I think lots of folks in their late twenties realize that the money habits we currently have are… well, let’s just be classy and say they’re “not serving us.”

But instead of googling for tips and keeping things under wraps, I’ve decided to be wayyyyy more public about my money journey.

Money & Feminism

And the reason? Because I’m a freakin’ feminist. I think that fear and lack of knowledge about money is used to keep people down, and negative feelings around the word “money” keep the people from living full and abundant lives.

LGBTQ People & Relationships with Money

And I ESPECIALLY think that queer folks don’t talk about money, mostly because we’re all twisted up inside about late-capitalism and blah blah blah. So we keep ourselves from making more money out of guilt – but that’s a blog post or conversation for another time.

Let me tell you where I’m at with money.

Money is Energy.

I know that money isn’t good or bad – it’s just a way to mark exchange. I don’t want to figure out how many sheep or pieces of wood I need to give Starbucks for a latte, so money really makes our lives easier.

Money is a means of exchange.

That’s it.

*We* assign characteristics or qualities to it.

Money is F*cking Political

That said, money comes with a looooot of baggage. And those issues keep you and me from working WITH our money. Those negative feelings around lack and worrying about money make it hard to be PROACTIVE with money.

So where do we start? How can YOU start getting your financial house in order? Well, let me share the helpful resources I’ve found up to this point, and you can share yours.

Tip #1: Check Your Bank Balance Every Dang Day

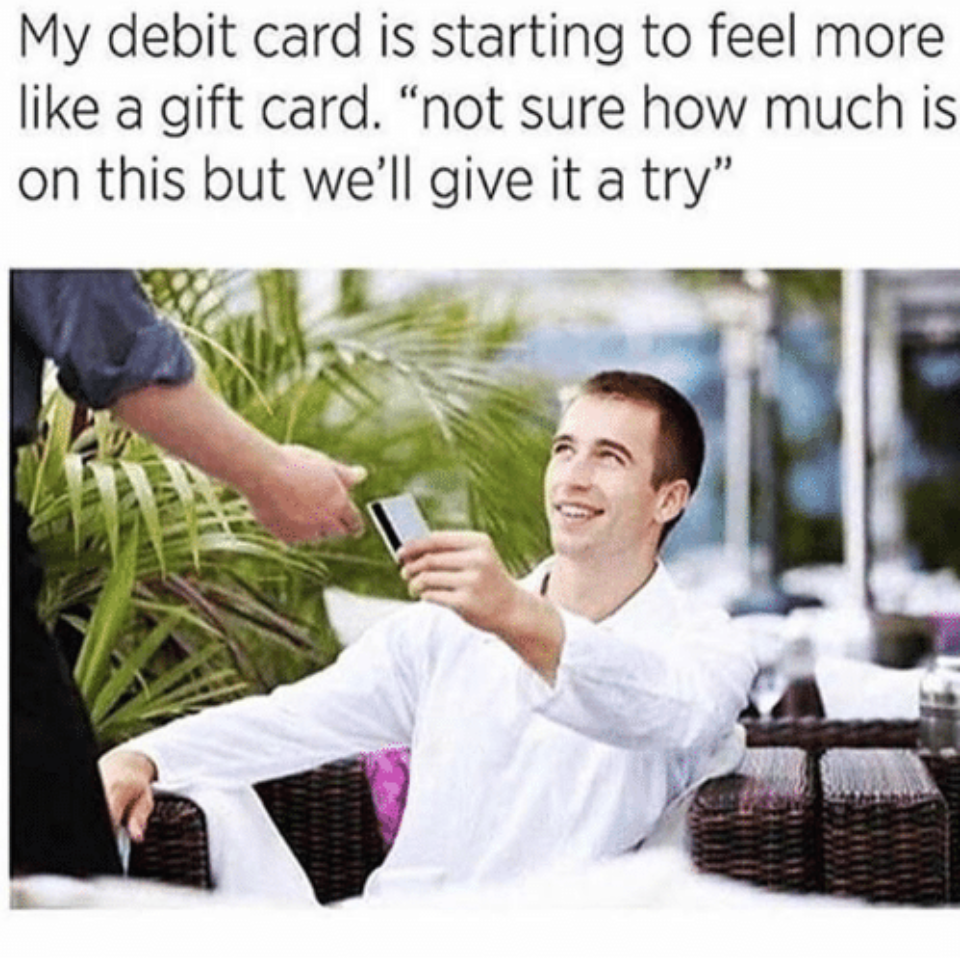

Have you found yourself handing over your debit card or credit card, and not really been sure how much is in the account? I know I’ve done it!

I had a switch in perspective when I decided to grow my personal wealth. As I started reading books and self-educating (more on that in a minute), I realized I needed to check my bank account balances every dang morning.

Set a reminder in your phone’s calendar to check your bank accounts every day. And then do it. Notice the anxiety and fear, and move through it. <3

Why is checking your bank accounts so important?

You measure what matters. You check your phone battery throughout the day and you check to see how full your tank is.

You cannot grow what you’re not paying attention to. Checking in with your money everyday helps you understand where you’re at. It’s a spiritual connection with the resources at your disposal.

We are No Longer Fearful.

When you hand over a card without knowing the balance on it, you are acting in fear. “I hope this goes through” or “I don’t even want to know what this card is at” are phrases that reflect a fearful state of being.

Creating abundance out of fear is pretty dang hard, and I would argue it’s impossible.

We Choose to Be Proactive

Check your bank account everyday to see where you’re at with your money, and move from a state of fear to being proactive. Knowing my numbers keeps me honest, and it has helped my business grow exponentially over the last year.

Mama is coming for that millionaire club.

Tip #2: Curate What You Put in Your Head

One of my favorite quotes is, “You are the average of the 5 people you spend the most time with.”

And that includes who you spend time with online. Be very careful of the people you follow and listen to, and be sure you’re following people who take a proactive and abundant mindset with money.

Search Out Authenticity.

I’m not saying to only follow people who believe in “Good vibes only.” No! That’s inauthentic and doesn’t work. Rather, I’m saying to follow people who are making moves, who are learning and sharing insights about money and who are making shit happen for themselves.

Make it your goal to find and follow 5 people with positive attitudes about money on social media. You can start with me. 😉

Tip #3: Daily Motivation, Affirmations and Adjustment

If you’re reading this blog post, it’s probably because you’ve decided that you don’t want to feel crappy about money anymore. But you (likely) aren’t sure how to combat the negative feelings and thoughts you have around money.

Change isn’t going to happen over night. For myself, I’ve found that daily personal development (~30 minutes a day) is critical to changing my mindset and experience.

Buy. This. Book.

I cannot recommend Jen Sincero’s, “You Are a Badass at Making Money” enough. I tell my clients to get the audio version (on Amazon here) and listen to it daily. After you’re done listening to it you can purchase the book and do the exercises.

It is not enough to listen to a book or speaker one time. Our brains absorb something like 20-30% of the information we hear or read. I have listened to this book probably 20+ times by now, and I keep it on replay.

This book is a good way to get introduced to the world of personal development. Jen (we’re on a first-name basis) gives real ways to use affirmations and adjustments to realign yourself – eventually leaving money negativity behind.

Details here.

Audible FTW

I have an audible subscription (audio books FTW) that I use to download personal development books, and I listen while I drive. You can listen while you cook or clean or as part of your mindfulness practice.

Get a 30-day trial here.

Yes, you can get audiobooks from your library. But if you can, I really recommend purchasing one so you can listen to it more than 1x without having to wait in line.

Tip #4: You Don’t Need to Make Your Own Plan – One Already Exists!

You don’t need to overhaul your spending and financial life TODAY. It starts with a lot of self-education and learning.

Also, you’re not alone in this! You don’t have to figure everything out yourself. If overwhelm is keeping you from moving forward (ie you feel the need to “solve” your financial life RIGHT NOW), I want you to take a deep breath.

I really like Ramit Singh’s book, “I Will Teach You to Be Rich” as it provides a systemized approach, a literal 6-week system that breaks down different tasks to do to get “money stuff” figured out.

He uses a real-talk perspective along with an abundance mindset (you don’t need to give up lattes) to help folks get their shit together.

Financial Advisors Are for Everyone – Including You

Additionally, you can meet with a financial advisor. Financial advisors are not just for people who have country club memberships. If you have money, talking to a financial advisor (fee or hourly based, not commission-based) is a great place to start.

Finally.

I’ll be writing more about money on the blog (does this make me a financial blogger?), so be sure to subscribe to my email list to keep in touch.

Also, I’m rooting for you. I believe you deserve to live an abundant and prosperous life. Truly. <3

[FTC Notice: This post contains affiliate links, meaning I earn a small commission if you purchase a product through my link. Affiliates help me write more great content, and I only endorse products I truly love.]